Crafting Dream Homes Residential Home Builders’ Expertise

Exploring Residential Home Builders’ Expertise

Residential home builders play a crucial role in turning dreams into reality, crafting homes that reflect the unique needs and desires of their clients. With their expertise and dedication, they transform visions into tangible spaces where families can create lasting memories.

Understanding Client Needs

At the heart of every residential home building project is a deep understanding of the client’s needs and aspirations. Builders take the time to listen to their clients, learn about their lifestyle, and understand their vision for their dream home. By building strong relationships with their clients, builders can tailor their services to meet individual preferences and ensure complete satisfaction.

Navigating Design and Planning

From the initial design phase to the final construction plans, residential home builders navigate every step of the building process with precision and care. They work closely with architects, engineers, and designers to develop comprehensive plans that translate their clients’ visions into detailed blueprints. By leveraging their expertise and attention to detail, builders ensure that every aspect of the home is thoughtfully considered and meticulously planned.

Craftsmanship and Quality

Craftsmanship lies at the heart of every home built by residential home builders. With a commitment to excellence and a dedication to quality, builders bring their clients’ dreams to life with precision and skill. From laying the foundation to installing the finishing touches, every aspect of the construction process is executed with care and attention to detail, resulting in homes that are built to last for generations.

Incorporating Innovative Solutions

Innovation is key to the success of any residential home building project. Builders stay abreast of the latest trends and technologies in the industry, incorporating innovative solutions to enhance the functionality, efficiency, and sustainability of their homes. Whether it’s integrating smart home systems, utilizing energy-efficient materials, or implementing eco-friendly design practices, builders strive to deliver homes that meet the needs of modern-day living.

Managing Construction

Managing the construction process is no small feat, but residential home builders excel in overseeing every aspect of the build with efficiency and expertise. From coordinating subcontractors and managing timelines to ensuring compliance with building codes and regulations, builders take on the responsibility of ensuring that the construction process runs smoothly from start to finish. Their hands-on approach and meticulous attention to detail ensure that each project is completed on time and within budget.

Ensuring Client Satisfaction

Ultimately, the success of a residential home building project is measured by client satisfaction. Residential home builders go above and beyond to ensure that their clients are delighted with the end result, providing personalized service and ongoing support throughout the entire process. By exceeding expectations and delivering exceptional homes, builders forge lasting relationships with their clients built on trust, integrity, and a shared commitment to excellence.

Embracing Collaboration

Collaboration is key to the success of any residential home building project. Builders work closely with their clients, architects, designers, and subcontractors to bring each vision to life. By fostering open communication and collaboration, builders ensure that every

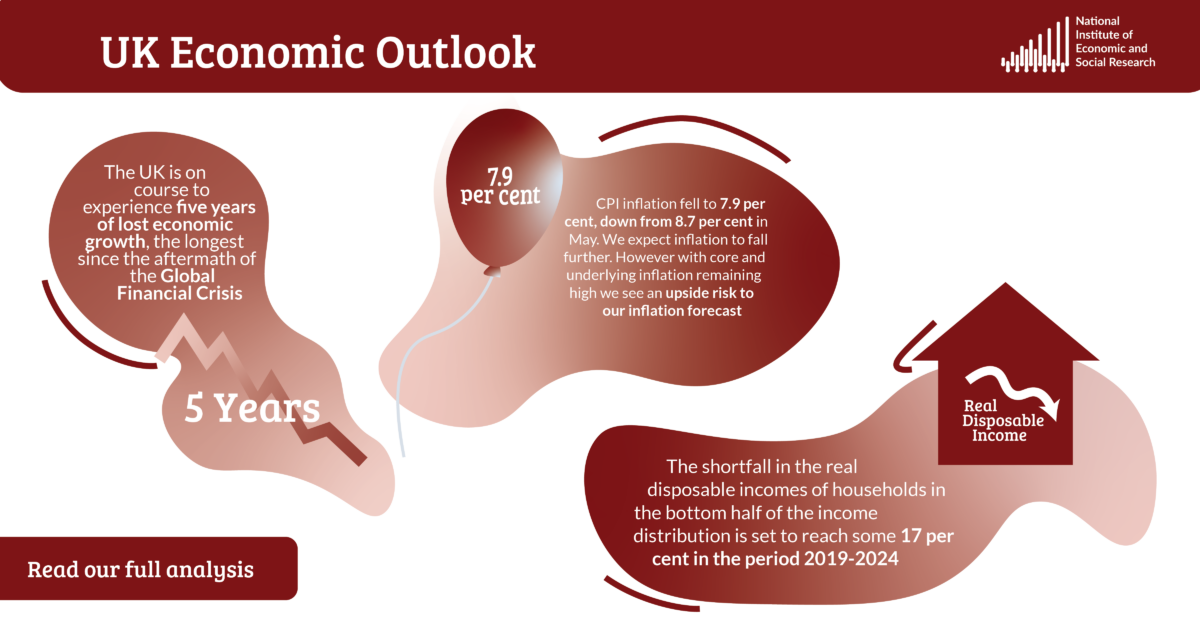

In these latest years, our company world has witnessed a extreme financial disaster due to the recessions and financial downturns. However despite these standards being essential to approval, there may be still no guarantee that a $10,000 personal loan for spotty credit will get the inexperienced light. The truth is that many lenders are aware that people who currently have a bad credit score used to have good credit or even glorious credit and for unexpected conditions their capability to acquire finance was heavily compromised. Pros and cons: The largest pluses of typical bank loans are that they carry low interest rates, and because a federal company shouldn’t be involved, the approval course of can be a little sooner.

In these latest years, our company world has witnessed a extreme financial disaster due to the recessions and financial downturns. However despite these standards being essential to approval, there may be still no guarantee that a $10,000 personal loan for spotty credit will get the inexperienced light. The truth is that many lenders are aware that people who currently have a bad credit score used to have good credit or even glorious credit and for unexpected conditions their capability to acquire finance was heavily compromised. Pros and cons: The largest pluses of typical bank loans are that they carry low interest rates, and because a federal company shouldn’t be involved, the approval course of can be a little sooner.

Had been greater simply by three per cent than what the costs have been throughout the same month in the 12 months 2011. With the opportunity of taking the service provider money advance loans , the corporate gets an excellent credit reputation and this can make it simpler for them to get different loan services in future. While a particular plan is still wanted to get approval, financial institution loans do not include such stringent use phrases that SBA loans do.

Had been greater simply by three per cent than what the costs have been throughout the same month in the 12 months 2011. With the opportunity of taking the service provider money advance loans , the corporate gets an excellent credit reputation and this can make it simpler for them to get different loan services in future. While a particular plan is still wanted to get approval, financial institution loans do not include such stringent use phrases that SBA loans do.

Fund your business progress with a mortgage that offers the flexibleness of fixed or variable interest rates. One of the first issues a financial institution will ask for is proof that the individual requesting the small business credit score has a good monetary standing in the neighborhood. We will get your loan accredited without sending your paperwork around to varied finance suppliers like different firms as this is only affecting your credit rating negatively.

Fund your business progress with a mortgage that offers the flexibleness of fixed or variable interest rates. One of the first issues a financial institution will ask for is proof that the individual requesting the small business credit score has a good monetary standing in the neighborhood. We will get your loan accredited without sending your paperwork around to varied finance suppliers like different firms as this is only affecting your credit rating negatively.