Navigating UK’s Economic Revival Key Recovery Indicators

Economic Rejuvenation Unveiled: Exploring Key Recovery Indicators in the UK

Recovery in the Wake of Challenges

As the United Kingdom charts its course toward economic recovery, a myriad of indicators comes into play, painting a nuanced picture of the nation’s economic health. These indicators serve as compass points, guiding policymakers, businesses, and individuals through the complex landscape of post-challenging times.

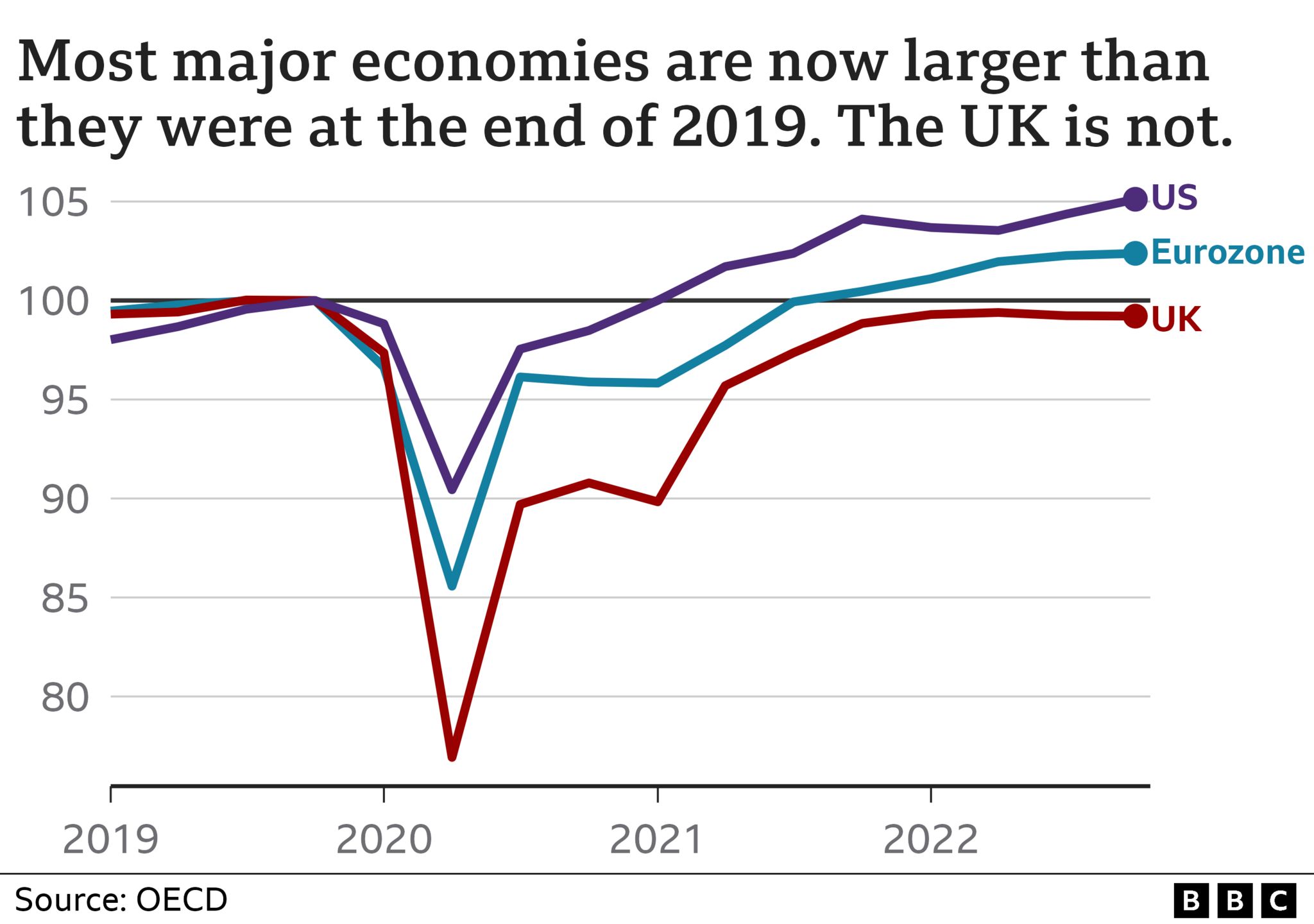

GDP Growth and Output

At the heart of economic recovery lies the Gross Domestic Product (GDP), a comprehensive measure of a nation’s economic performance. Monitoring GDP growth and output provides a pulse on the overall economic health. It reflects the value of goods and services produced, offering insights into the nation’s economic trajectory.

Employment Rates and Labor Market Dynamics

A thriving economy is intricately linked to employment rates and the dynamics of the labor market. Monitoring unemployment rates, job creation, and workforce participation unveils crucial aspects of economic recovery. A resilient labor market not only signifies individual prosperity but also contributes to the broader economic revival.

Consumer Spending Patterns

Consumer spending is a powerful engine that drives economic activity. Analyzing spending patterns offers a glimpse into consumer confidence and economic optimism. As individuals regain confidence in the economy, increased spending becomes a key indicator of recovery, stimulating business activities and fostering growth.

Investment Flows and Business Confidence

Investment, both domestic and foreign, plays a pivotal role in economic rejuvenation. Monitoring investment flows and business confidence levels provides crucial insights. Increasing investments indicate a favorable business environment, signaling trust in the economic prospects and potential for sustained growth.

Housing Market Resilience

The housing market serves as both an indicator and a contributor to economic recovery. Monitoring housing prices, sales volumes, and construction activities provides a gauge of economic vitality. A buoyant housing market often reflects consumer confidence and positive economic sentiment.

Inflation and Price Stability

Balancing inflation is a delicate act in economic recovery. Moderate inflation is often seen as a sign of a healthy economy. Monitoring price stability and inflation rates ensures that the purchasing power of the currency remains resilient, fostering an environment conducive to sustained economic growth.

Government Fiscal Policies and Stimulus Measures

Government interventions through fiscal policies and stimulus measures play a crucial role in economic recovery. Monitoring the effectiveness of these policies provides insights into their impact on various sectors. The success of targeted stimulus measures can spur economic activity and hasten the recovery process.

Global Trade Relations and Export Performance

In an interconnected world, global trade is a significant determinant of economic health. Monitoring the UK’s trade relations and export performance provides a comprehensive view of its standing in the global marketplace. A robust export sector contributes to economic resilience and vitality.

Technological Advancements and Innovation

The role of technology and innovation cannot be overstated in modern economic recovery. Monitoring technological advancements and innovation indices reflects a nation’s ability to adapt and thrive in a rapidly changing global landscape. Embracing technological progress becomes a key driver of sustained economic growth.

Exploring Economic Recovery Indicators in