Your First Rental Property A Smart Investment

Why Rental Properties Make Sense

For many, the idea of owning a rental property feels daunting, a step into the unknown realm of landlord-hood. But the truth is, owning rental properties can be a fantastic way to build wealth and secure your financial future. Beyond the potential for passive income, rental properties appreciate in value over time, creating a substantial asset that grows alongside the property market. This slow-and-steady growth offers a powerful hedge against inflation, something many other investment vehicles struggle to provide consistently. The long-term benefits far outweigh the initial effort, making it a worthwhile pursuit for those with a long-term vision.

Choosing the Right Property: Location, Location, Location

The adage “location, location, location” holds especially true in the rental market. Research is paramount. Consider the local rental market – what’s the average rent for similar properties? Is there high demand? Look at the property’s proximity to schools, employment centers, and amenities. A well-located property will attract more tenants and command higher rent, minimizing vacancy periods and maximizing your return on investment. Don’t just focus on the immediate area; consider future development plans that could positively or negatively impact the property’s value and rental demand.

Financing Your First Rental: Navigating the Mortgage Maze

Securing a mortgage for a rental property is different than getting a mortgage for your primary residence. Lenders will scrutinize your credit score, income, and debt-to-income ratio more rigorously. They’ll also want to see a detailed rental projection, demonstrating your ability to cover the mortgage payments even if the property is vacant for a period. Shopping around for the best mortgage rates is essential, and it’s wise to speak with a mortgage broker who specializes in investment properties. They can guide you through the process and help you secure the most favorable terms.

The Importance of Thorough Due Diligence

Before signing on the dotted line, conduct a thorough inspection of the property. Hire a qualified home inspector to identify any potential problems, from minor repairs to significant structural issues. Review the property’s history, checking for past code violations or significant maintenance expenses. This diligent approach will save you from costly surprises down the road and allow you to factor these potential expenses into your financial projections.

Managing Your Rental Property: Hands-On or Hands-Off?

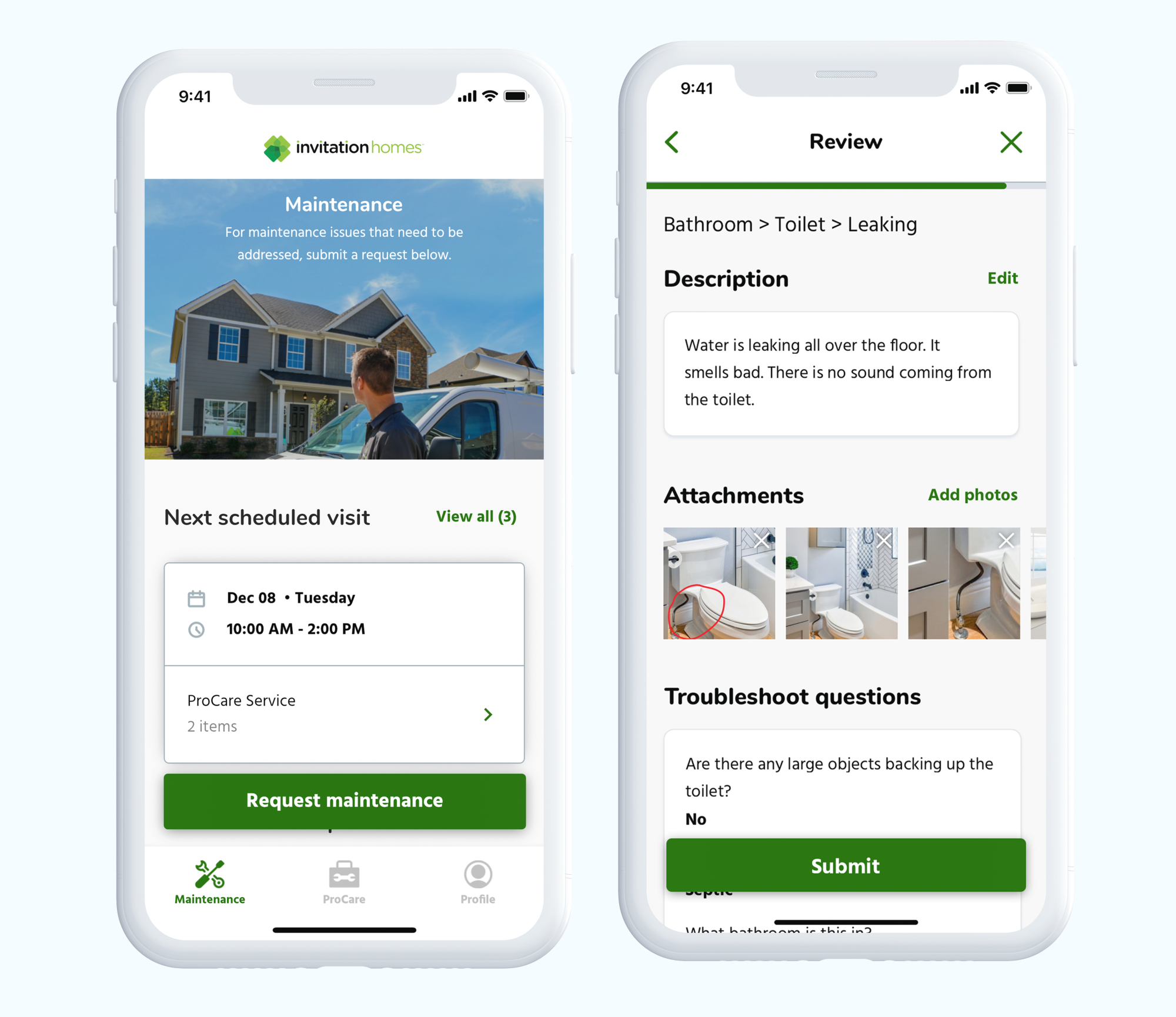

Managing a rental property involves various tasks, from screening tenants and collecting rent to handling maintenance requests and adhering to landlord-tenant laws. You can choose a hands-on approach, managing everything yourself, or opt for a property management company. A management company will handle much of the day-to-day operations for a fee, freeing up your time, but it will reduce your overall profit. Weigh the pros and cons of each approach based on your time constraints, experience, and comfort level.

Legal and Tax Considerations: Protecting Your Investment

Understanding the legal and tax implications of owning a rental property is crucial. Familiarize yourself with landlord-tenant laws in your area, including regulations regarding lease agreements, security deposits, and eviction procedures. Consult with a tax advisor