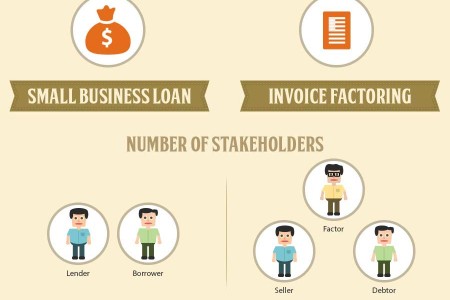

We perceive that increasing and rising your business is the dream of each entrepreneur. This has turn out to be very easy for a lot of peoplesince they don’t have the prospect of constructing the funds of the loans provided in different sectors. The wisest thing to do is to look online, there are numerous on-line lenders providing very cheap interest rates and you’ll be able to get quotes from them and examine charges and fees earlier than making a call. With cash advance loans you may acquire in a matter of hours, all the funds you need to finance your holiday journey. Merchant money advance: One of these loan is made to a business primarily based on the amount of its monthly credit card transactions. With these loans, the government isn’t immediately lending small businesses money. You might have been began to get the wonderful studies concerning the a bad credit score personal loans of getting permitted.

We perceive that increasing and rising your business is the dream of each entrepreneur. This has turn out to be very easy for a lot of peoplesince they don’t have the prospect of constructing the funds of the loans provided in different sectors. The wisest thing to do is to look online, there are numerous on-line lenders providing very cheap interest rates and you’ll be able to get quotes from them and examine charges and fees earlier than making a call. With cash advance loans you may acquire in a matter of hours, all the funds you need to finance your holiday journey. Merchant money advance: One of these loan is made to a business primarily based on the amount of its monthly credit card transactions. With these loans, the government isn’t immediately lending small businesses money. You might have been began to get the wonderful studies concerning the a bad credit score personal loans of getting permitted.

I just bought a loan from JK LOANS yesterday, i imply $450,000.00 cash by way of bank to bank transfer…attempt them they are certified, trustworthy, dependable, environment friendly, Quick and dynamicwonderful, ship them a mail at present at jkservice01@.

And I don’t want even my enemy to cross by such hell that I passed through within the hands of those fraudulent online lenders,i will even need you to assist me cross this data to others who are additionally in need of a mortgage after getting additionally obtain your mortgage from Mr. Kelvin Brown, i pray that God should give him lengthy life.

These secured and unsecured personal loans and horrible credit private loans are for folks with or with out low credit in Johannesburg, Gauteng, Cape Town, Durban, Pretoria, Port Elizabeth and other major cities across South Africa.

However, a majority of these loans usually include shorter compensation times than SBA loans and often include balloon funds. Hi, im a proffessional nurse by occupation employed by gauteng healh division.i’ve a number of loans i wana consolidate and to do this i would like about R100 be capable to pay about R4000 month-to-month. Actual property and tools loans: The CDC/504 Mortgage Program provides businesses with lengthy-term mounted-charge financing for major belongings, resembling equipment and real estate. Launching your business would require getting the capital you want for operational expenses. Instead of paying for the large purchases unexpectedly up front, gear loans allow business owners to make monthly payments on the gadgets. Irrespective of which sort of mortgage you choos, it may be an excellent assist to your poor credit score scores or it might finish in disaster.