Hiring The Right Speaker For The Success Of Business Events

Hiring The Right Speaker For The Success Of Business Events

The meetings business is a multi-billion industry. Seasoned meeting professionals know that there are tons of things that must come together to ensure that a program comes off without a hitch, but those who attend conferences, trade shows, conventions, seminars, sales meetings, users conferences and other gatherings only see the surface.

The meetings business is a multi-billion industry. Seasoned meeting professionals know that there are tons of things that must come together to ensure that a program comes off without a hitch, but those who attend conferences, trade shows, conventions, seminars, sales meetings, users conferences and other gatherings only see the surface.

A glitch in the sound system that is fixed before anyone enters the room goes un-noticed. The wrong font on the nametags is hardly an issue to the person wearing the tag. The behind the scene decisions matter, but they are invisible.

A blah tasting meal might underwhelm the audience’s taste buds, but a blah speaker will undermine their enthusiasm for being present. The speakers, especially the first speaker, sets the tone for the whole meeting. Yet often the kick-off keynote is some executive who gets up and drones on about the state of the business or industry. Few meetings give much thought to into who is best to get the meeting launched.

The answer is not always the status quo. Creativity is king.

If you are planning an event you should work with everyone who will take the stage to discuss how their presentation will impact the audience. While most meetings focus on the long-term “learning objectives”, they discredit the power of the short term “motivation objectives”. A speaker who cannot raise the level of excitement in an audience will not positively impact the meeting, regardless of the knowledge they share.

Just because someone is smart or has done something cool does NOT mean they belong on the stage.

Hiring the right speaker for the success of a business event is critical. The best meeting professionals spend a lot of time searching for the right speakers to headline their conferences. They are not as concerned with celebrity as they are with impact.

If your company or organization is having a meeting that will require outside speakers, it is best to start early in your search for those who can deliver powerful presentations. Understand that professional speakers charge money for their speaking. However, you usually get a better presentation from a professional than you do from a “free” industry speaker. This does not mean that there are not great “free” speakers out there, but they often are speaking to promote their main business. This can lead speakers who deliver a sales pitch to your audience. Of course you can have the same issues with paid professionals. The best thing to do is to talk with people who have seen the speaker (do not simply rely on videos) to understand what their message contains.

Be clear with everyone you consider hiring as to what you want from their presentation. Do not just let a speaker “wing it”. Long conversations when you hire them and then again the week before the presentation will help prevent them from getting off track from your goals for audience.…

The creation of Payment Card Industry compliance, better known as PCI compliance aims to protect personal information and to offer security when using payment cards. Because of its importance, there is the need for the whole payment card industry to comply with the standards in case they wish to accept credit cards. Failure to meet the standards may mean fines from banks and credit card companies, or even the loss of the ability to process credit cards.

The creation of Payment Card Industry compliance, better known as PCI compliance aims to protect personal information and to offer security when using payment cards. Because of its importance, there is the need for the whole payment card industry to comply with the standards in case they wish to accept credit cards. Failure to meet the standards may mean fines from banks and credit card companies, or even the loss of the ability to process credit cards. The United States Department of Health and Human reported this week that laptop theft is the number one cause of health data breaches. Last year alone, the United States reported 275,000 cases of health data infringement. Health data theft is a different breed of identity theft that can result in fraudulent acquirement of prescription drugs and medical equipment. Snuko, P.L.C., a leading British anti-theft software company has proactive answers for those in the medical community concerned about this kind of thievery.

The United States Department of Health and Human reported this week that laptop theft is the number one cause of health data breaches. Last year alone, the United States reported 275,000 cases of health data infringement. Health data theft is a different breed of identity theft that can result in fraudulent acquirement of prescription drugs and medical equipment. Snuko, P.L.C., a leading British anti-theft software company has proactive answers for those in the medical community concerned about this kind of thievery. When it comes to an online service company or a merchant that is using the credit card companies Visa, MasterCard, American Express, Discover, or Japan Credit Bureau, to process their cashless purchasing transactions, the merchant’s agreement with the transaction processing bank is binding. This agreement ultimately determines what security procedures and requirements the merchant must meet to continue to use the card processing equipment and to continue with the cashless transactions.

When it comes to an online service company or a merchant that is using the credit card companies Visa, MasterCard, American Express, Discover, or Japan Credit Bureau, to process their cashless purchasing transactions, the merchant’s agreement with the transaction processing bank is binding. This agreement ultimately determines what security procedures and requirements the merchant must meet to continue to use the card processing equipment and to continue with the cashless transactions. It is certainly true that any reference to magic

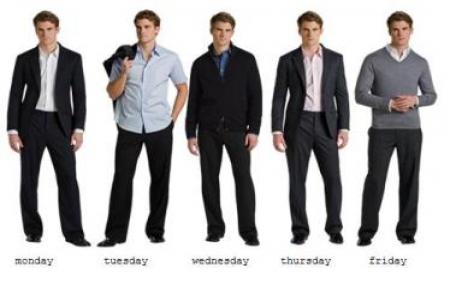

It is certainly true that any reference to magic 1. Fashion is a Business!

1. Fashion is a Business!

It appears that Wal-Mart plans on setting up hundreds of C-Stores (convenience stores) in the near future, and many of these will be completed before 2012. Why is Wal-Mart getting into the C-Store business you wonder? Well, and many of their superstores also sell fuel, and since more and more patrons are using the Sam’s Club card, and Wal-Mart credit cards to buy fuel, they may as well have a C-Store out front for everybody. Can Wal-Mart compete in this venue?

It appears that Wal-Mart plans on setting up hundreds of C-Stores (convenience stores) in the near future, and many of these will be completed before 2012. Why is Wal-Mart getting into the C-Store business you wonder? Well, and many of their superstores also sell fuel, and since more and more patrons are using the Sam’s Club card, and Wal-Mart credit cards to buy fuel, they may as well have a C-Store out front for everybody. Can Wal-Mart compete in this venue?