Programs offered by our lenders include private loans, accounts receivable financing, working capital, automotive auto loans, scholar debt consolidation, development condo, bridge exhausting cash, actual property financing, house mortgage refinance buy, equipment leasing, franchise, healthcare medical, service provider money advance, acquisition mergers, massive project financings, buy orders, trade, small business loans and unsecured business traces of credit. Most often, the utmost loan amount is 8 % of the sales a business has processed by PayPal in the past 12 months. SBA Group Benefit Loans are one of the best choices accessible to startups and new businesses, supplied you could have a superb to wonderful credit score.

Programs offered by our lenders include private loans, accounts receivable financing, working capital, automotive auto loans, scholar debt consolidation, development condo, bridge exhausting cash, actual property financing, house mortgage refinance buy, equipment leasing, franchise, healthcare medical, service provider money advance, acquisition mergers, massive project financings, buy orders, trade, small business loans and unsecured business traces of credit. Most often, the utmost loan amount is 8 % of the sales a business has processed by PayPal in the past 12 months. SBA Group Benefit Loans are one of the best choices accessible to startups and new businesses, supplied you could have a superb to wonderful credit score.

As soon as it finds you a associate, Lendza guides you through the method of acquiring financing on your business. Chase, American Categorical and Capital One all offer small business credit cards with wonderful rewards programs and sign-up bonuses. The bottom line is, you wish to find the perfect lenders who provides business loans for unfavorable credit ratings in Dallas. The MUDRA (Micro Models Growth and Refinance Agency Ltd) Yojana launched this yr affords loans for as much as Rs. 10 lakh at low interest rates. Goals for VA Small and Veteran Business Applications are aggressive and geared toward most utilization. You probably have a decrease credit rating, both Wells Fargo and BBVA additionally supply secured small business bank cards. Approvals are made inside in the future, with funds accessible as quickly as two business days later.

This lender presents business cash advances, service provider money advances, and both secured and unsecured business loans. To qualify, businesses must have been in operation for at the least one yr, and will need to have annual income above $one hundred,000 and a personal credit score rating of at the very least 500. Grameen America is able to spend money on women who haven’t any credit scores, no business plans and may present no collateral. P2Bi’s revolving traces of credit are secured by accounts-receivable and/or stock.

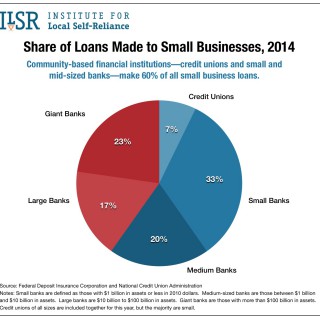

The location is a mortgage alternate that connects small business homeowners with greater than 4,000 business lenders. With the Hybrid Program, the cash advance is paid back via a combination of a holdback proportion of your credit card gross sales and a weekly fee. Lendio makes business loans by matching certified small business owners with energetic banks, credit unions and different lending sources. Some banks, however, put a small business focus entrance and heart, including First-Residents Bank and Belief Company, and Financial institution of the West, whose business lending makes up 27.7% and 10.2% of their whole loans.

As a result of you understand how lenders at all times go straight to checking your credit history and if less than shining, most of them will not settle for your loan request. Some debtors discover making a big fee each month is a larger burden on their business than weekly or daily funds. We’re a non-revenue organization, headquartered in Texas that helps small business homeowners with limited entry to capital have a chance to stay their goals. A adverse credit small business mortgage might be availed by all types of bad credit businessmen. Capital for Merchants: Capital for Retailers is a business money-advance lender.