Strategic Acquisition Agreements: Navigating Business Growth

In the dynamic landscape of business, strategic acquisition agreements serve as a potent tool for companies seeking expansion, diversification, and enhanced market positioning. These agreements, marked by meticulous planning and negotiation, play a pivotal role in shaping the trajectory of business growth.

Strategic Vision: Driving Expansion Initiatives

At the core of acquisition agreements is a strategic vision that propels business expansion. Companies often leverage acquisitions to enter new markets, gain access to innovative technologies, or diversify their product/service offerings. This strategic foresight is the driving force behind the decision to pursue growth through acquisition.

Identifying Targets: Precision in Selection

The success of an acquisition largely hinges on the identification of the right target. Companies engage in thorough market research and due diligence to pinpoint entities that align with their strategic goals. Whether it’s about acquiring complementary capabilities or entering a new geographic region, precision in target selection is paramount.

Negotiation Dynamics: Crafting Mutually Beneficial Deals

Negotiation is an art in the realm of acquisition agreements. Both parties bring unique strengths to the table, and the negotiation process involves striking a balance that ensures mutual benefit. From determining the purchase price to defining the terms of the deal, negotiation dynamics shape the contours of the acquisition agreement.

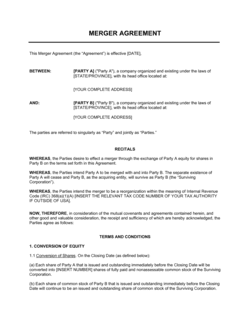

Legal Framework: Ensuring Compliance and Clarity

The intricacies of acquisition agreements demand a robust legal framework. Contracts are meticulously drafted to ensure compliance with regulatory requirements and to provide clarity on various aspects, including the transfer of assets, liabilities, and the protection of intellectual property. Legal scrutiny is a crucial step in fortifying the foundation of the agreement.

Financial Considerations: Valuation and Investment Strategy

Valuation is a critical aspect of acquisition agreements. Determining the fair value of the target company involves evaluating its assets, liabilities, and potential for future earnings. The financial considerations extend beyond the purchase price to encompass the overall investment strategy, including financing options and the potential return on investment.

Integration Planning: Seamlessly Merging Operations

Successful acquisition agreements go beyond the signing of the deal; they encompass meticulous integration planning. Companies must navigate the complexities of merging operations, systems, and cultures. Integration planning is a strategic endeavor that aims to achieve synergies and ensure a smooth transition for both entities.

Cultural Alignment: Fostering a Unified Identity

The cultural aspect is often underestimated in acquisition agreements. Companies must assess and align their organizational cultures to foster a unified identity. Cultural integration is not just about policies and procedures; it’s about cultivating a shared ethos that transcends the transition, ensuring harmony and collaboration.

Stakeholder Communication: Transparency is Key

Amidst the intricacies of acquisition, communication with stakeholders is paramount. Transparency in conveying the strategic rationale behind the acquisition, the anticipated benefits, and the integration plan is crucial for maintaining trust. Effective communication mitigates uncertainties and fosters a positive reception among employees, customers, and investors.

Post-Acquisition Assessment: Measuring Success

The journey doesn’t end with the acquisition; it extends to a post-acquisition assessment phase. Companies evaluate the success of the acquisition based on predefined metrics and strategic objectives. This ongoing assessment informs future decisions, shaping the company’s trajectory in the ever-evolving landscape.

In the realm of business growth, Acquisition agreements represent a strategic maneuver that requires a delicate blend of vision, precision, negotiation prowess, and meticulous execution. Beyond the legal intricacies and financial considerations, the success of an acquisition hinges on the ability of companies to navigate the human and cultural dimensions, fostering a unified identity that propels the collective entity toward sustained growth and success.