Factors To Think about Earlier than You Get A Loan

A Bank of America mortgage that is guaranteed by the Small Business Administration (SBA) stands out as the proper alternative on your business. It sounds fairly strange however it’s all true with service provider cash advance loans Take pleasure in this peculiar function by calling on to the customer support professionals to avail one good mortgage at the earliest in your higher prospects. For instance, a credit card can be used to accumulate a loan at a decrease rate for paying off or reducing a mortgage that is at a much higher price. Additionally, interest rates are not often charged, and the repayment schedule is extraordinarily versatile. Most lenders are keen to grant a $10,000 personal mortgage for horrible credit administration functions, but not all of them provide good phrases in the deal. You should begin your search with a session with you r local Small Business Administration company.

A Bank of America mortgage that is guaranteed by the Small Business Administration (SBA) stands out as the proper alternative on your business. It sounds fairly strange however it’s all true with service provider cash advance loans Take pleasure in this peculiar function by calling on to the customer support professionals to avail one good mortgage at the earliest in your higher prospects. For instance, a credit card can be used to accumulate a loan at a decrease rate for paying off or reducing a mortgage that is at a much higher price. Additionally, interest rates are not often charged, and the repayment schedule is extraordinarily versatile. Most lenders are keen to grant a $10,000 personal mortgage for horrible credit administration functions, but not all of them provide good phrases in the deal. You should begin your search with a session with you r local Small Business Administration company.

Others are known to triple the interest rates without informing the shoppers and this ends up being unfair to the borrowing get together. This manner, the lender will take note of the co-signer credit report when deciding whether or not to approve your mortgage or not. If a borrower does not have collateral, a lender may require the borrower to have a near excellent credit score rating. No credit score verification loans are offered during Christmas and have change into highly regarded as a result of they are often accepted inside less than a day. Changing four or 5 loans with one consolidation loan greatly reduces month-to-month payments.

Yet that’s the expertise of many small business house owners who for a wide range of causes have to have loans, strains of credit, or other small business credit score so as to keep their business afloat. We provide the above sorts of loans all at 5% interest which is among the most cost-effective around the World. Accessing funds in monetary emergencies may be difficult, especially with horrible credit. These are two phrases that one must be familiar with when considering a business mortgage, just because banks contemplate both of those when determining whether or not to approve the mortgage.

Discovering the suitable funding can be a challenge but by way of our marketplace of seventy five+ lenders, we’ll match you with traditional and non-conventional lenders who understand the complexities of startup businesses. A few of my friends own businesses and discover it tough to fulfill payroll and discover it especially exhausting to fulfill the price of growing on this financial system. Some downsides of a working-capital mortgage are that they typically include increased rates of interest and have short compensation phrases.

Bank signature loans require favorable credit, payday cash advances do not, making it a lovely mortgage for folk with poor credit. Nevertheless, there isn’t a cause to assume the standard lenders so hesitant to lending to bad credit report borrowers have to be approached. A commercial actual estate mortgage (also referred to as a commercial mortgage) must include the plans to …

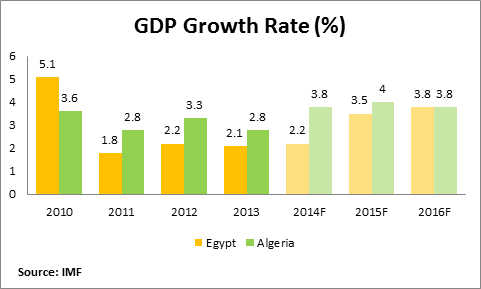

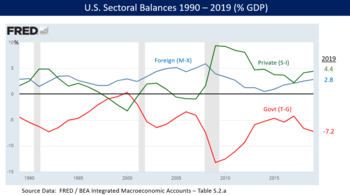

To analyze an financial system as an entire, economists have developed different models. Certainly, 2016 GDP progress was the worst since 2011… while inflation expectations have shot greater. Yet increasingly the U.S. financial system is itself influenced by dynamic economies overseas. In essence, what the large authorities spending is looking for to do is return the economic system to a level of exercise that was itself dependent on the credit score bubble and extra authorities spending. Finally, more than half of the Democratic voting block was unaware that President Obama had increased troop ranges in Afghanistan, while 39% of Republicans had been likewise misinformed. Yet despite these main set backs and the necessary price of the battle the economy nonetheless grows and all key indicators are nonetheless working within the optimistic. With oil costs rising and international demand selecting up, the economy appears set for continued growth.

To analyze an financial system as an entire, economists have developed different models. Certainly, 2016 GDP progress was the worst since 2011… while inflation expectations have shot greater. Yet increasingly the U.S. financial system is itself influenced by dynamic economies overseas. In essence, what the large authorities spending is looking for to do is return the economic system to a level of exercise that was itself dependent on the credit score bubble and extra authorities spending. Finally, more than half of the Democratic voting block was unaware that President Obama had increased troop ranges in Afghanistan, while 39% of Republicans had been likewise misinformed. Yet despite these main set backs and the necessary price of the battle the economy nonetheless grows and all key indicators are nonetheless working within the optimistic. With oil costs rising and international demand selecting up, the economy appears set for continued growth.