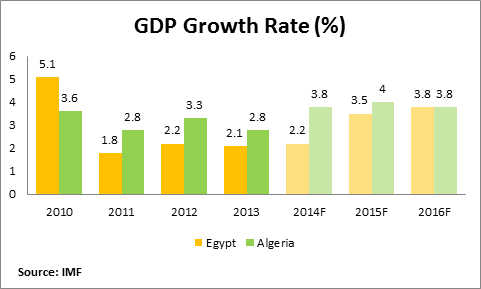

To analyze an financial system as an entire, economists have developed different models. Certainly, 2016 GDP progress was the worst since 2011… while inflation expectations have shot greater. Yet increasingly the U.S. financial system is itself influenced by dynamic economies overseas. In essence, what the large authorities spending is looking for to do is return the economic system to a level of exercise that was itself dependent on the credit score bubble and extra authorities spending. Finally, more than half of the Democratic voting block was unaware that President Obama had increased troop ranges in Afghanistan, while 39% of Republicans had been likewise misinformed. Yet despite these main set backs and the necessary price of the battle the economy nonetheless grows and all key indicators are nonetheless working within the optimistic. With oil costs rising and international demand selecting up, the economy appears set for continued growth.

To analyze an financial system as an entire, economists have developed different models. Certainly, 2016 GDP progress was the worst since 2011… while inflation expectations have shot greater. Yet increasingly the U.S. financial system is itself influenced by dynamic economies overseas. In essence, what the large authorities spending is looking for to do is return the economic system to a level of exercise that was itself dependent on the credit score bubble and extra authorities spending. Finally, more than half of the Democratic voting block was unaware that President Obama had increased troop ranges in Afghanistan, while 39% of Republicans had been likewise misinformed. Yet despite these main set backs and the necessary price of the battle the economy nonetheless grows and all key indicators are nonetheless working within the optimistic. With oil costs rising and international demand selecting up, the economy appears set for continued growth.

The studying fell short of expectations of economists surveyed by Bloomberg News, who had forecast 2.2 p.c annualized development in the period. Economist Anthony Chan says productiveness will enhance in 2017 and so will the labor pressure and perhaps even earnings.

In the meantime, the monetary media is abuzz with the notion that by some means US GDP development of 5% is just across the nook primarily based on the view that Trump can by some means conjure up growth inside a month or two (not possible). As alluded to on the earlier submit, the financial overview in the West it seems has morphed right into a dichotomy of Inexperienced (sustainability) versus limitless Development. The hope was that US financial system would pick up in the second half of 2016 – yet one more bout of optimism that’s losing pressure. A look beneath the hood exhibits that the U.S. is likely stuck in the same growth trap during which it has found itself because the Great Recession ended.

Traditionally, productivity development has complemented demand progress to ship broad-based prosperity—and whereas the hyperlink between productivity and wage progress might have weakened in recent many years, it still exists. With that being the case, the distress that 2016-Q4’s dividend cuts is speaking suggests that its confirmation of a fading U.S. economic system was a contributor to the outcome of last week’s elections within the U.S. These strikes have drawn praise from the business neighborhood and generated much of the bullish sentiment about the future of the economic system under Trump that is mirrored in recent positive aspects on Wall Avenue. One factor this nation has to guard is its national interests, as our economic system is wrapped up with everybody else.

Many of the hit came from soybean exports, which fired up GDP development within the third quarter after a poor harvest in Argentina and Brazil. Deteriorating infrastructure, wage stagnation, rising revenue inequality, elevated pension and medical prices, as well as large present account and authorities budget deficits, are all points going through the US economy. In truth, the US is in the middle of a major army buildup – the Obama administration’s Asia Pivot” within the Pacific. The oil production sector of the U.S. financial system is in second place, accounting for slightly below 1 / 4 of all dividend cuts introduced thus far. But it seems that too few within the authorities and within the media have been trumpeting the excellent news.