Learn About Small Business Loans

We will offer you safe login particulars to add extra documentation for our lending experts to evaluation. Fundbox: Fundbox gives business house owners a approach to repair their cash circulate by advancing payments for their outstanding invoices. To qualify, businesses must have been in operation for greater than three months, have income of greater than $100,000 over the previous 12 months and have a credit score rating larger than 500. Do not over-lengthen your credit score: Too many loans or open strains of credit score now can harm your means to get credit score later. The amount for which a business can qualify depends on business and private credit, time in business, the quantity of kit owned, and product sales. Financial establishments evaluation your credit score report earlier than reviewing and subsequently approving or rejecting your mortgage software. CapFusion: CapFusion offers competitive, flexible loans based mostly on knowledge for businesses that need money to quickly and efficiently fund their development. CAN Capital: CAN Capital gives small business loans and merchant money advances.

We will offer you safe login particulars to add extra documentation for our lending experts to evaluation. Fundbox: Fundbox gives business house owners a approach to repair their cash circulate by advancing payments for their outstanding invoices. To qualify, businesses must have been in operation for greater than three months, have income of greater than $100,000 over the previous 12 months and have a credit score rating larger than 500. Do not over-lengthen your credit score: Too many loans or open strains of credit score now can harm your means to get credit score later. The amount for which a business can qualify depends on business and private credit, time in business, the quantity of kit owned, and product sales. Financial establishments evaluation your credit score report earlier than reviewing and subsequently approving or rejecting your mortgage software. CapFusion: CapFusion offers competitive, flexible loans based mostly on knowledge for businesses that need money to quickly and efficiently fund their development. CAN Capital: CAN Capital gives small business loans and merchant money advances.

A mid-level non-banking financial establishment, Shriram Transport Finance had started off offering loans to its prospects based mostly on automobiles required for the aim of business. Different banks have different necessities to provide small business loans with the exception of some some basic documentation. Angela serves as a member of the District Workplace BOS crew and is chargeable for the complete scope of the Company’s government contracting and business improvement packages. To qualify, it’s essential to have been in business for no less than a yr, have a private credit score over 500 and annual income of greater than $one hundred,000. Tools Finance: Provided to purchase new tools or lease equipment for business models.

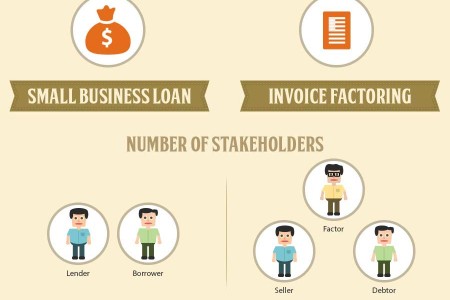

The lender presents a wide range of loan types, together with working-capital loans, business growth/acquisition loans, SBA loans, strains of credit, equipment financing, stock financing, accounts receivable factoring and merchant cash advances.

Fountainhead Commercial Capital: Fountainhead Business Capital is a lender of Small Business Administration (SBA) 504 loans. It pays for a business’s future sales up front and gets paid again with a hard and fast share of day by day bank card receipts, or via computerized debits from a checking account on a set schedule. All you need to do is check out home loans for individuals with a bad credit score Your property will in fact now not be paid off but you may at least have some money to get on high of your entire payments. Company Business Lending: Corporate Business Lending makes a speciality of working with business house owners who have less-than-excellent credit score.

Credit history: Borrowers ought to be aware of their credit report to ensure that it’s up-to-date and accurate. Small Business Loans Depot: Small Business Loans Depot presents an assortment of mortgage varieties, including financial institution-statement loans, small business loans, working-capital loans, tools loans and tools refinance loans. SBA 7(a) loans are among the greatest financing accessible to any entrepreneur, but they are particularly nice for …

BizBuyFinancing is a nationwide specialty mortgage consulting and SBA financing facilitator for business purchase financing. A.Whereas both help businesses discover funding, lending marketplaces use expertise to rapidly current small businesses with a number of funding choices from a variety of funding companions that can fulfill each specific situation, stated Stephen Sheinbaum, founding father of Bizfi , an alternate finance company.

BizBuyFinancing is a nationwide specialty mortgage consulting and SBA financing facilitator for business purchase financing. A.Whereas both help businesses discover funding, lending marketplaces use expertise to rapidly current small businesses with a number of funding choices from a variety of funding companions that can fulfill each specific situation, stated Stephen Sheinbaum, founding father of Bizfi , an alternate finance company.

Because the banks appeared to stop lending small business loans, life’s received a bit of more durable for small businesses who need to borrow. Direct Capital offers tools financing and dealing-capital loans of as much as $a hundred and fifty,000, and franchise financing of up to $250,000. Micro loans are offered provided there is a sturdy business plan and a profitable enterprise. When they’re unable to acquire conventional financing for his or her business needs, we are here to assist them.

Because the banks appeared to stop lending small business loans, life’s received a bit of more durable for small businesses who need to borrow. Direct Capital offers tools financing and dealing-capital loans of as much as $a hundred and fifty,000, and franchise financing of up to $250,000. Micro loans are offered provided there is a sturdy business plan and a profitable enterprise. When they’re unable to acquire conventional financing for his or her business needs, we are here to assist them.

…

… This article is designed to provide candid and practical help for funeral dwelling financing. It makes use of its algorithm to search out and match a borrower with one of the best provider for a small business mortgage. The variety of small businesses began by ladies has grown at a charge faster 5 occasions faster than the nationwide common since 2007. Goldman Sachs 10,000 Small Businesses is an investment to help small businesses create jobs and financial alternative by offering larger access to business training, monetary capital, and business assist providers. We’ll give you access to information to help you put together for your loan, and quickly assess the right lending opportunities to your business. In case you want a loan that enormous and you have below-average credit, you might be in WAY over your head. Lendio: Lendio is a web-based service that helps small businesses rapidly find the precise business mortgage.

This article is designed to provide candid and practical help for funeral dwelling financing. It makes use of its algorithm to search out and match a borrower with one of the best provider for a small business mortgage. The variety of small businesses began by ladies has grown at a charge faster 5 occasions faster than the nationwide common since 2007. Goldman Sachs 10,000 Small Businesses is an investment to help small businesses create jobs and financial alternative by offering larger access to business training, monetary capital, and business assist providers. We’ll give you access to information to help you put together for your loan, and quickly assess the right lending opportunities to your business. In case you want a loan that enormous and you have below-average credit, you might be in WAY over your head. Lendio: Lendio is a web-based service that helps small businesses rapidly find the precise business mortgage.

Everybody you admire in life for his or her success, achievement or character has paid one value or the other to get to where they are that will get your consideration and admiration. While feminine entrepreneurs have historically struggled to safe financing, there are a number of programs that goal to make capital more accessible to women. All businesses that accept bank cards are eligible for a money advance from FastUpFront. With new business loans it’s possible you’ll be credited anything from $15,000 to $ 250,000, relying on the evaluation the collateral you might be mortgaging. Business Credit & Capital: Business Credit & Capital specializes in providing merchant money advances to retailers, eating places and service businesses. But everybody will not be capable of afford the expenditure of purchasing or lease land, building the office set-up and the other prior costs of business. After a business receives the advance, this lender deducts a fixed percentage of the business’s each day bank card gross sales till the advance is paid in full.

Everybody you admire in life for his or her success, achievement or character has paid one value or the other to get to where they are that will get your consideration and admiration. While feminine entrepreneurs have historically struggled to safe financing, there are a number of programs that goal to make capital more accessible to women. All businesses that accept bank cards are eligible for a money advance from FastUpFront. With new business loans it’s possible you’ll be credited anything from $15,000 to $ 250,000, relying on the evaluation the collateral you might be mortgaging. Business Credit & Capital: Business Credit & Capital specializes in providing merchant money advances to retailers, eating places and service businesses. But everybody will not be capable of afford the expenditure of purchasing or lease land, building the office set-up and the other prior costs of business. After a business receives the advance, this lender deducts a fixed percentage of the business’s each day bank card gross sales till the advance is paid in full.

Starting a Chiropractic observe on a finances is not straightforward but it’s achievable with time and dedication! Its platform matches businesses with institutional traders to fund loans ranging from $10,000 to $one hundred fifty,000. These loans are a particular type of seven(a) loan designed specifically for brand spanking new and underserved businesses, which means they offer the identical aggressive interest rates and phrases as normal 7(a) loans. These loans are desirable in quite a lot of instances, corresponding to when a business does not but have a confirmed monitor record. A small business proprietor can fulfill numerous purposes with a bad credit small business mortgage. Headway Capital: Headway Capital affords small businesses lines of credit starting from $5,000 to $30,000. Defend Funding gives business cash advances and unsecured business loans of up to $500,000 for a variety of functions. The business loans are broadly categorized into two types, secured and unsecured.

Starting a Chiropractic observe on a finances is not straightforward but it’s achievable with time and dedication! Its platform matches businesses with institutional traders to fund loans ranging from $10,000 to $one hundred fifty,000. These loans are a particular type of seven(a) loan designed specifically for brand spanking new and underserved businesses, which means they offer the identical aggressive interest rates and phrases as normal 7(a) loans. These loans are desirable in quite a lot of instances, corresponding to when a business does not but have a confirmed monitor record. A small business proprietor can fulfill numerous purposes with a bad credit small business mortgage. Headway Capital: Headway Capital affords small businesses lines of credit starting from $5,000 to $30,000. Defend Funding gives business cash advances and unsecured business loans of up to $500,000 for a variety of functions. The business loans are broadly categorized into two types, secured and unsecured.

This is the final in a collection of three hubs justifying progressive taxation. Balboa Capital: Balboa Capital gives a number of small business mortgage products, including working-capital loans, franchise loans, equipment leasing, and flexible small business loans. Swift Capital: Swift Capital gives quick business funding, with quantities ranging from $5,000 to $300,000 and interest rates beginning as low as 9.9 p.c. Laghu Udhyami Credit score Cards: Finance to small retail traders, artisans and MSE units.

This is the final in a collection of three hubs justifying progressive taxation. Balboa Capital: Balboa Capital gives a number of small business mortgage products, including working-capital loans, franchise loans, equipment leasing, and flexible small business loans. Swift Capital: Swift Capital gives quick business funding, with quantities ranging from $5,000 to $300,000 and interest rates beginning as low as 9.9 p.c. Laghu Udhyami Credit score Cards: Finance to small retail traders, artisans and MSE units.

Nationwide funding blog featuring: Corporate credit score, business credit, unsecured business credit, business lines of credit score, unsecured business credit score lines, small business credit score, firm credit score, get corporate credit score, industrial credit score, business credit score traces, acquire business credit score, fast business credit score, start up business credit, instantaneous business credit score, onerous money, bridge, personal funding. And I do not wish even my enemy to go through such hell that I passed by in the arms of those fraudulent on-line lenders,i may also want you to help me move this info to others who are additionally in need of a mortgage once you have additionally receive your loan from Mrs.

Nationwide funding blog featuring: Corporate credit score, business credit, unsecured business credit, business lines of credit score, unsecured business credit score lines, small business credit score, firm credit score, get corporate credit score, industrial credit score, business credit score traces, acquire business credit score, fast business credit score, start up business credit, instantaneous business credit score, onerous money, bridge, personal funding. And I do not wish even my enemy to go through such hell that I passed by in the arms of those fraudulent on-line lenders,i may also want you to help me move this info to others who are additionally in need of a mortgage once you have additionally receive your loan from Mrs.

…

… Entrepreneurs and small business house owners with very bad credit discover this much more frustrating because one of many first things wanted to get a business off the bottom is money. Businesses can usually receive an advance of as much as a hundred twenty five p.c of their monthly transaction volume. The most effective candidates for service provider cash advances are businesses with strong credit card sales, reminiscent of retailers, restaurants and service businesses. Business credit cards are gaining in popularity as a result of they permit for both brief and long run purchases and may provide money to help with sudden bills. While you work with us, you understand you’re getting the small business loan that best fits your needs. The only minimal that you must respect are the interests (just like some credit cards).

Entrepreneurs and small business house owners with very bad credit discover this much more frustrating because one of many first things wanted to get a business off the bottom is money. Businesses can usually receive an advance of as much as a hundred twenty five p.c of their monthly transaction volume. The most effective candidates for service provider cash advances are businesses with strong credit card sales, reminiscent of retailers, restaurants and service businesses. Business credit cards are gaining in popularity as a result of they permit for both brief and long run purchases and may provide money to help with sudden bills. While you work with us, you understand you’re getting the small business loan that best fits your needs. The only minimal that you must respect are the interests (just like some credit cards).